Charitable Contributions: How Much Can You Write Off.

Writing off charitable donations only works for qualified organizations. To claim a tax deduction for your charitable gifts, the organization you’re donating to has to have the seal of approval from the Internal Revenue Service. Essentially, it has to be an eligible organization with tax-exempt status.

To write off cash contributions, make sure records are kept detailing areas such as a canceled check, bank record, or a receipt with the charity’s name, date of the donation, and the total amount.

Collection of tax write off donation letter template that will perfectly match your needs. When creating a formal or business letter, presentation design and format is crucial making a great very first perception. These themes offer outstanding examples of the best ways to structure such a letter, and also consist of example web content to.

Most people are keenly aware that they get a tax deductible write off when they tithe or donate money to a charitable organization like their local church. But some seem to forget that the deduction also applies to noncash donations like clothing, shoes, and furniture, so long as they are in reasonably good condition.

If you would like to write off charity donations on your taxes be sure you have all receipts and a flawless record of your donations. When you file your taxes itemize the deductions on the.

A common question we receive is about Goodwill tax deductions or tax write off for donations to Goodwill. According to IRS regulations, a non-profit organization like Goodwill cannot provide a donor with the dollar value of an in-kind gift. There are many sources to locate reasonable values for your donations.

A letter of donation can be used by those giving and those requesting donations. For example someone who wishes to give a sum of money or property to a charitable organization, may send a letter accompanying their donation, including their personal details and a short note about the reasons why they chose to give.

To write off any cash contributions, no matter how small, you need a canceled check, bank record or a receipt with the charity's name and donation amount. That means that putting cash in the church collection plate or the Salvation Army bucket is a no-no if you want to be able to take a deduction for it.

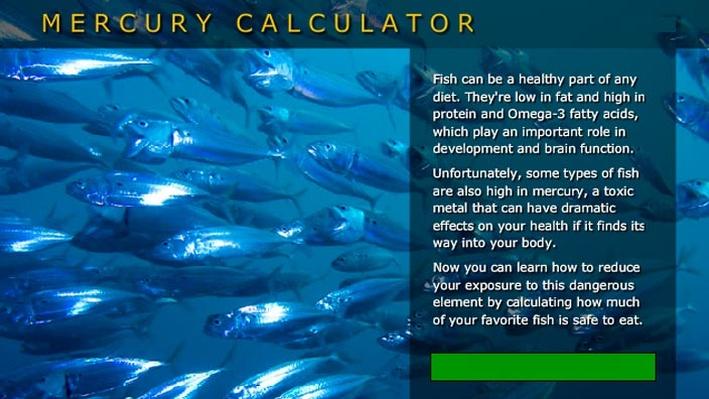

Can You Write off Charitable Donations in 2020? Under section 170 of the Internal Revenue Code, donations to charitable organizations are tax-deductible as an itemized deduction in 2020. To verify if an organization is eligible for tax-deductible contributions, taxpayers can search the new IRS database, Tax Exempt Organization Search (TEOS).

Charitable donations can take many forms, but here are five common opportunities: 1. Monetary contributions. If you donate cash or make a cash-equivalent contribution to a qualified charitable organization, your generosity is generally rewarded with a deduction for the full amount. The limit for all annual donations, including cash gifts, is 50.

The ability to write off donations to various organizations that are for-profit varies widely throughout the world. In some cases, it is possible to deduct a percentage of the donation, while in others a donation to anything other than a non-profit entity does not merit a tax deduction of any type. Further, there is no guarantee that a given organization will maintain its status from one year.

The government rewards generous people, allowing them to write off certain kinds of donations from their taxes. Writing off donations can be a tricky business, so you need to pay close attention to a number of factors, such as the beneficiary of your donations, the proper valuation and documentation, the forms you need to fill out and others. To help you write off your donations properly.

Asking businesses for donations is not always an easy task. If you are conducting a benefit, business donations are often needed to help raise funds for charity. When requesting donations from businesses, there are several important tips you should follow. The letter should be brief, to the point and should catch the reader’s attention. You should also place a lot of emphasis on the positive.