Write off customer and vendor balances - QuickBooks Community.

Go to the Lists menu and select Chart of Accounts. Select the Account menu and then New. Select Expense, then Continue. Enter an Account Name, for example, Bad Debt.

In the direct write-off method, when after a few years of trying to recover the amount the invoice is declared as bad or uncollectible, it is directly written off or expensed out in the income statement by debiting bad debt expense and crediting accounts receivable.

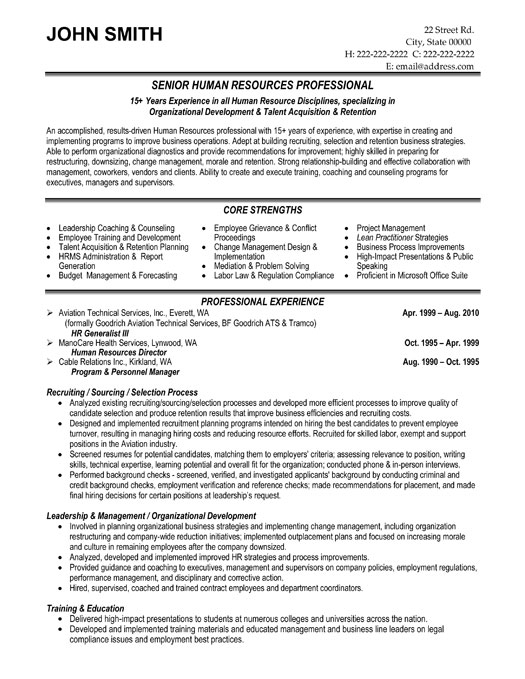

When you are ready to write off the bad debt in QBO, you should follow these steps: Set Up Your Account. If you do not already have a bad debt expense account in your chart of accounts, you should set that up first. Then, go to products and service under the gear icon and create a service item called bad debt for coding on your invoices.

As I wish to credit back the VAT to HMRC for all invoices aged above 6 months I was intending to write off invoice at the same time, whilst appreciating that there is a risk, albeit small, that the supplier(s) may chase up these invoices at a later date and then I'll need to reverse the write off, I'm willing to take that risk but want to make.

Should long outstanding trade creditors and other account payables be written off or derecognized in a similar way to the write-off of account receivables considered irrecoverable? What are the circumstances under which accounts payable balances may be written off or reversed?

The entry to write off the bad account under the direct write-off method is: Debit Bad Debts Expense (to report the amount of the loss on the company's income statement) Credit Accounts Receivable (to remove the amount that will not be collected).

To write off an uncollectible account receivable, you record a credit memo and then apply the credit memo to the uncollectible account. The item shown on your credit memo should cause the allowance for uncollectible accounts to be debited.

Go to the Company menu and click Chart of Accounts. Click the Account button at the bottom of the list and then click New. Click Expense and then click Continue. If you are using account numbers, enter the account number in the Number field.

Accounts receivable is a list of how much money you are owed by customers and other businesses. QuickBooks allows you to enter your accounts receivables directly and also increases the accounts receivable total upon the generation of an invoice.

Cash Basis Accounts Receivable Write Offs When an invoice becomes uncollectible and the books are kept on a cash basis, there are two alternative methods for recording the credit memo. The first alternative is to create a credit memo exactly the same as the invoice.

How can I write off unused client credit notes? Didn't find your answer?. The ones I would like to write off are several years old and belong to old customer who have not ordered from us in years and are unlikely to do so in the future.. created an income account called Unclaimed Credits and any credit notes not within the current year.

Business plan vision and mission statement; Database design modeling resume; Five paragraph essay outline format sample; Gender pay gap thesis; Formula one research paper.

Wanting to get a jump on preparing for year end? Here are a few suggestions on cleaning up your Accounts Receivable Aged Trial Balance before the year-end crunch begins: Review your accounts receivable detail reports and confirm that all invoices listed are valid.