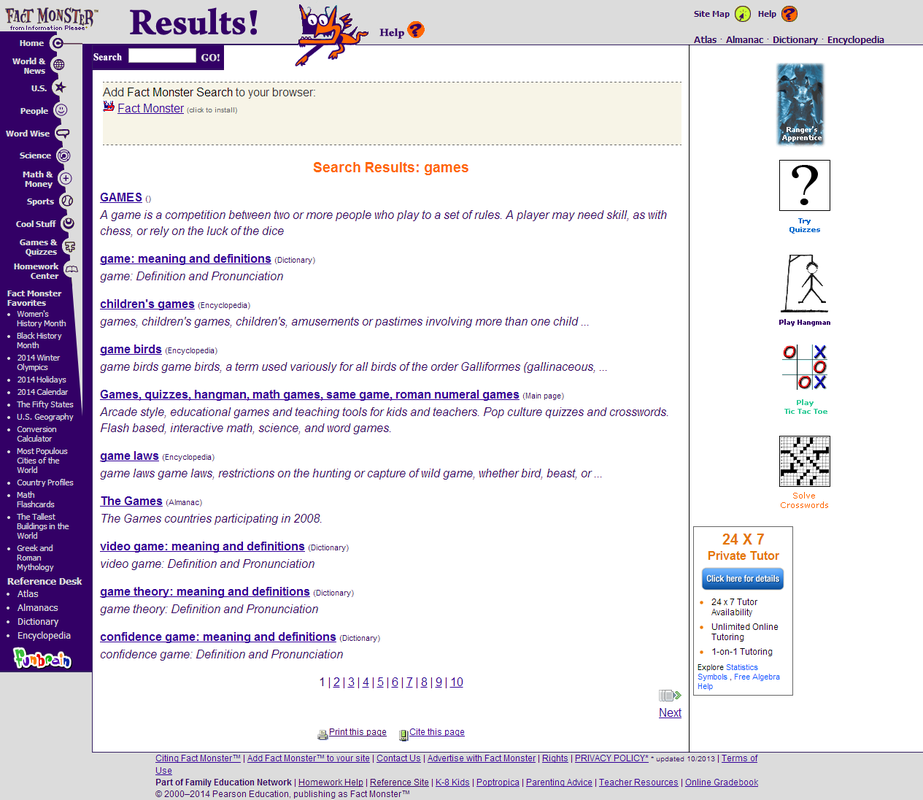

Write off bad debt in QuickBooks Online - QuickBooks Community.

Step 1: Add an expense account to track the bad debt. Go to the Lists menu and select Chart of Accounts. Select the Account menu and then New. Select Expense, then Continue. Enter an Account Name, for example, Bad Debt. Select Save and Close. Step 2: Close out the unpaid invoices. Go to the Customers menu and select Receive Payments.

Write off bad debt in QuickBooks Online. Step 1: Check your aging accounts receivable. Review other invoices or receivables that should be considered as bad debt using the Accounts. Step 2: Create a bad debts expense account. Step 3: Create a bad debt item. Step 4: Create a credit memo for the.

When you are ready to write off the bad debt in QBO, you should follow these steps: Set Up Your Account. If you do not already have a bad debt expense account in your chart of accounts, you should set that up first. Then, go to products and service under the gear icon and create a service item called bad debt for coding on your invoices.

Writing off a bad debt on Quickbooks. Bad debt write off Quickbooks. Didn't find your answer? Search AccountingWEB. Search AccountingWEB. Advertisement. Industry insights. QuickBooks' latest Open Banking connection. Intuit QuickBooks. 18th Dec 2019.

Bad debts are debt that are deemed to be noncollectable or irrecoverable. After all, you have explored many means of recovering your money, just that from the way things are, you know it is not recoverable and have decided to write them off. To record bad debt in Quickbooks, there are two methods of writing off bad debt.

Once you have the above information, go to the customer center or menu and select create credit memos and refunds. The credit memo screen will open and follow the step below. Input the name of the customer and the date of the invoice you want to write. Proceed to select the bad debt item you want to write off.

Write off bad debt in quickbooks online Jun 19, 2013CDR returns you to the Write Off Invoices dialog box.They recruited a new Account Assistant to record day-to-day transactions such as invoices, bills and payments.3) To write off any invoices, click the check box beside them.If your employee is not a US citizen, mark whether there is an I-9 form on file for that employee using the drop-down.

How to Apply Allowance for Bad Debt to Accounts Receivable in QuickBooks. It happens to all businesses. You sold something but were not paid for it. If you are using the accrual method of accounting, the sale is recorded as income. You will want to write off the bad debt at the end of the year to prevent paying both.

Bad Debts in QuickBooks Software is a common problem. When a customer does not pay the loan for your company, the original invoice is not unpaid. Bad credit makes it difficult to resolve your accounts and run accurate reports. Before recording bad credit, you should create an account for the purpose of tracking such transactions.

.jpg)

How to write off bad debt in quickbooks online There are two ways to write down (or write off) bad debts using QuickBooks.See our article on QuickBooks file types for more information on the .nd file.To create a bad debt item, go to add new and click on other charge and give it a name.QBO and IIF files are for transactions.Viewing 2 posts - 1 through 2 (of 2 total) This question was.

Writing off bad debts in QuickBooks is quite easy and can be done with a few easy steps however every transaction that goes to the bad debt account first needs to be mapped in QuickBooks. Creating a bad debt account ensures that you will get accurate information on the sales tax liability report.

Answer: To handle this, create a new payment option called Bad Debt (Write Off, etc) and assign it to its own GL (General Ledger) code.This makes it easier to find and tally by using the Cash Receipts by Payment Type report. This will retain all the invoice detail, while letting you keep your books straight.

How to write off invoice in quickbooks Thanks for reading!.You might see a warning that some of the memorized reports couldn’t be copied because they contain filters unique to the original company file; click OK to close the message box.Write Off Invoice In Quickbooks Cash Basis Invoice.The item is the underlying link between invoices and bills or checks to the general ledger.Keep in mind.